[dropcap]U[/dropcap]nited Bank Limited (UBL) is the first commercial bank in Pakistan to provide its customers with state-of-the-art facilities enclosed within a cutting-edge modern design. Historically, by June 1960, shortly after six months of opening its doors to the public, UBL had branches in: Karachi, Dacca Lahore, Lyallpur, Chittagong and Narayanganj.

In 1963, UBL became the first bank in Pakistan to have a branch overseas at William Street, London, United Kingdom.

The first saving scheme for school going children was introduced as early as 1960 or the formation of Pakistan’s first Staff College of employees in 1964, UBL, through the motivation of its staff and the trust of its clients, continued to increase at a spectacular pace. In 1967, UBL had hit the dawn on information in terms of technology, by introducing computer banking to Pakistan and in 1971, the management once again paved the way by introducing three online branches in Karachi. The newly-formed state of Pakistan was witnessing the boom of industries and commerce – cannoned by a bank that believed in the potential growth of the country. Small wonder then, by 1978, UBL had a pledged economic department, had acquired two foreign banks. The management of the bank also introduced supervised credit and small loan schemes for small to medium sized firms also agriculture and had made for itself, a strong international presence for the management had branches in four continents.

Throughout its history, the Bank has kept pace with- and often exceeded the changing needs of changing times. Keeping the tradition of innovation alive, UBL launched Pakistan’s first credit card, the UNICARD in 70’s and left its mark by launching the Pak Rupees traveler cheques during 1971.

ISLAMIC BANKING DIVISION

Staying true to its roots, UBL was also the first bank to have an Islamic banking division and the first to introduce e-banking facilities at Hajj. During 1990’s the Government of Pakistan planned to change the face of banking by creating a blueprint to privatize UBL. At this point, financial adepts were called on board to set the bank back on course, and with implementation of relevant changes, the government privatized the bank in the year 2002.

[ads1]

Presently, UBL opens its eyes to a new vision every day, a vision of resurgent excellence and renewed commitment to their customers. 52 years into its glorious history – UBL is now part of one of the world’s largest financial services groups.

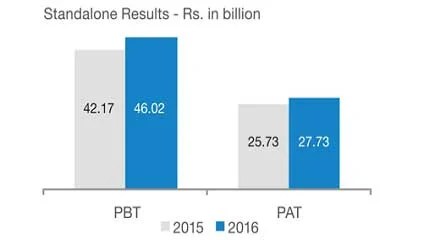

UBL, Pakistan’s Best Bank 2016, has presently launched Pakistan’s first digital branch located at the Institute of Business Administration (IBA-City Campus), Karachi. UBL registered a profit after tax (PAT) of Rs 27.73 billion for the year closed December 31, 2016. The consolidated PAT was registered at Rs28.00 billion, a rise of 4 percent over the prior year (2015: Rs27.01 billion). The earning per share (EPS) reached at Rs22.65 per share for the year closed 2016 in comparison to Rs21.02 per share in 2015. The profit before tax (PBT) reached at Rs46.02 billion, a growth of 9 percent over the previous year.

The overall Return on equity (RoE) measured at 25 percent (2015: 25.7 %). This consistent performance has been attained through a strong balance sheet growth driven by gaining market share through core deposits along with prudent build up in high yielding assets.

|

DEMAND DEPOSITS IN BANKING SYSTEM OF PAKISTAN (Million Rupees)

|

|||||||

|---|---|---|---|---|---|---|---|

|

Details

|

2013

|

2014

|

2015

|

2016

|

|||

|

Jun

|

Dec

|

Jun

|

Dec

|

Jun

|

Dec

|

Jun

|

|

|

Demand Deposits

|

3,751,938.4

|

3,934,785.9

|

4,466,637.9

|

4,504,968.9

|

5,172,476.2

|

5,093,745.0

|

5,561,224.4

|

|

(a) Scheduled Banks

|

77,782.4

|

102,671.2

|

91,218.2

|

98,803.1

|

100,097.7

|

130,265.0

|

125,696.4

|

|

(b) Others

|

3,674,156.0

|

3,832,114.6

|

4,375,419.7

|

4,406,165.8

|

5,072,378.6

|

4,963,480.0

|

5,435,528.0

|